Only three days to go until payday. Only three more days. Just three more days.

Despite all our best calculations the new budget is going...well...it's going. We were at "zero" by last weekend, then dipped slightly below because I had about $30 in piano recital expenses I forgot to plan for.

We can do this dipping below zero because zero isn't actually zero. When I do the bills, I take all the larger, but predictable ones (like electricity) and deduct half from each paycheck, so we don't get socked just because of the billing cycle. The problem with this system, though, is that when you go under zero, it eats into the little shadow funds I've set up to deal with things like biannual car insurance, pool passes, etc.

Right now we're at negative $28 (which I'll have to make up from a piano check).

Three days until payday. Just three more days.

It's hard to be optimistic when you have no eggs in the refrigerator, let alone in one basket. Clearly, if I'm going to become an optimist, some changes will have to be made to our finances.

So I look to the experts. Today: Dave Ramsey.

Dave Ramsey has a popular radio show on personal finance and is apparently a well-known public speaker. I'd never heard of him, though, until I saw some advertising for a recent appearance in Kansas City. There was a lot about "hope" and "inspiration."

Hmm, I remember thinking. Maybe I'll go. Then I looked it up online. Tickets were over $30. So no, I didn't go.

I did the next best thing. I read his book The Total Money Makeover. (I didn't spend money on it, of course. I checked it out of the library. Sorry, Dave.)

In Makeover, Ramsey pitches a series of "baby steps" that, if followed correctly, would have you living off your investments in your golden years. Primarily, it's all about saving money for an emergency fund, paying off and clipping up credit cards and then going to work on the home mortgage, retirement and college savings.

There's a lot to like about this. As a member of a low-debt family (we only have our low-interest college loans and a remaining 8 years on a 15-year mortgage) we know the benefit of staying off the credit cards. Those things are evil, no two ways about it. And Ramsey knows how to keep up a patter that keeps you moving through the pages. It's quick and the complex issues are well explained.

But there's also quite a lot that's irritating about The Total Money Makeover.

First, you have to wade through a lot--and I mean a lot--of testimonials to get to the meat of his advice. I did a quick count and found 51 pages of italicized success stories from fans. That's about 21 percent of the total pages in the book. And these are only the italicized sections, mind you. There are plenty more stories woven into the body type, along with a lot of sales talk from Ramsey about why you should follow this plan. OK. I get it, I get it. You're a motivational speaker. It's what you do.

It would be a little easier to take, though, if the examples weren't so cherry-picked. Most of the people report wild spending on boats and fancy cars they could not afford. Some were in hock for $25,000, $40,000, $85,000 and more. Ramsey loves to talk about how financial fitness is like losing weight so I'll make the same comparison here. These testimonials are like those obesity shows, where the hugely overweight makeover subjects have cupboards loaded with Twinkies and buckets of Gummi Worms. Your own extra flab gets excused (gee, I'm not as bad as them), but there's nothing to help you lose that last 10 pounds.

Should the guy with $70,000 in credit card debt sell his fancy motorcycle? Well, duh. But how can the average middle class person ever get ahead when employers have been eroding his/her paycheck steadily for a decade?

This book is copyrighted 2003 and that's part of the problem. A lot of Ramsey's advice goes out the window when you're in an economic collapse as bad as this has been.

Income a problem? Simply go out and find another job to moonlight. Or sell the house and move into a less expensive place. Use your profits from the house sale to pay off debt and with the extra, invest in money market funds.

See what I mean?

To be fair, I checked the Internet to see if Ramsey has updated his advice for the recession and...oh dear. He did not see this one coming. In early 2008, he blamed the media for overplaying economic fears and said the economy was robust and safety nets would prevent a crash. (Here's a report about an interview on the Early Show).

As for our own situation, we have the emergency fund. Check. We have credit cards paid off. Check. But our sudden and precipitous income drop now makes it impossible (temporarily, we hope) to continue to pay the college loans.

The next step Ramsey would recommend would be increasing income by either a) selling something or b) moonlighting.

We've already thought about the selling. So far this year, we sold an old weight machine and parts from a broken trampoline. But that profit went to buy a replacement trampoline. Unlike Ramsey's success stories, we don't have a garage full of expensive junk. No speedboats. No furs. Most of our furniture was refinished from garage sales and the occasional garbage picking trip. I have a few mostly sentimental things from my grandmother, but they're worth more to me than they would be to anyone else.

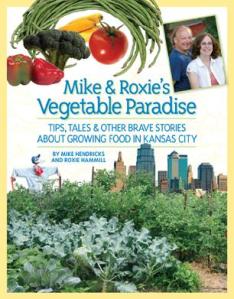

So our best hope is for extra work. We have the book, but that's future income (we certainly hope). There aren't enough hours in the day to add other work on top of piano teaching, the column the book and the resume writing.

Ramsey is very big on psychology. He's adamant, for instance, that you should pay off the loan with the smallest balance first, regardless of interest rates--just for the psychological victory.

So it's strange that he ignores one of the big psychological reasons people overspend. Their children.

That's how we went wrong. Even in times we had debt paid off, we'd delve right back in again to get the things that give our children a chance in life and to make them happy. The encyclopedias, the lessons, the sports teams. When you're rewashing plastic bags and never going out to eat or to a movie, you just get so tired of always telling your kids, "no, no, no." They're only going to be with you a few years of your life.

Should we have taken that road trip through the Southwest? Or the driving trip to Seattle for a special soccer camp? Should we have gotten a life-sized wall poster of football player Cristiano Ronaldo for $100, when it was the only thing she wanted for Christmas? (And it was!) Probably not. But then again, we have family memories that can never be replaced. Under Dave's plan, we would never have done any of that because we would be focused with "gazelle-like intensity" on saving and investing.

I get the impression Dave never had to deal with these issues. Or maybe his wife did all of that, I don't know.

So what will I do differently now that I've read The Total Money Makeover? Well, I'm a bit more enthused about going through the shed and basement for old construction stuff we could sell. The problem is finding enough time to do it plus the other jobs I'm taking on in hopes of making more money.

Maybe I should invest in some No-Doze.

1 comment:

Hey, Roxie! I work at the Star, which means I share your pain. I'm generally a Dave Ramsey fan, although he loses me when he slides into religion (which I slid OUT of many year ago).

I listen to him for at least a few minutes nearly every day on 710 AM, and I think his advice is sound, but his basic assumption seems to be that if you're having financial problems, it's because you are living beyond your means. Well, Mr. Ramsey, we did just what you said and took out a 15-year fixed-rate mortgage with a payment that was easily within our means. Then, OUR "MEANS" PLUMMETED! He really does not seem to understand that that happens.

Hang in there. Things WILL turn around for us all. I just wish we had some idea of WHEN.

Post a Comment